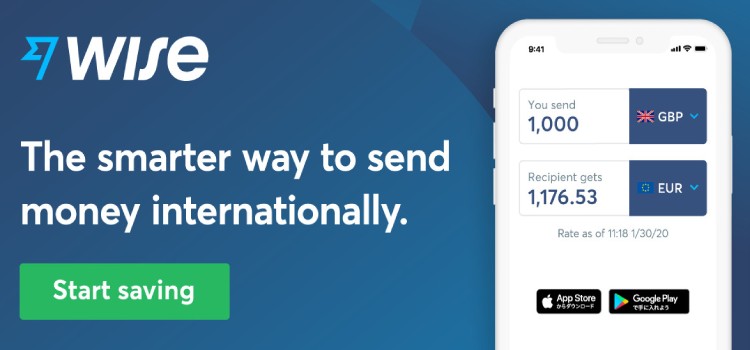

Wise 2023 Review: Pros And Cons

- Rahul Manchanda

- Mar 22, 2023

- 6 min read

Wise comes with loads of special features, and it doesn’t mark up its rates for currency exchanges. Although money can be sent to more than 100 countries from India, its services might come at a considerable cost as it charges higher transfer fees, including an extra charge if the receiver is not in the U.S., than some of its competitors. Its other drawback: There is no option for delivery of cash to a home or business.

If you’re looking for an international money transfer service that’s cheap, Wise might not be the best pick. Wise is upfront about the fact that it’s not always the least expensive option, and the potentially higher cost might turn off some people.

However, some users might find a higher fee is a worthwhile tradeoff for a potentially speedy Wise transaction. Another advantage: Wise stands out from some of its competitors by not marking up exchange rates to fatten profits. The company boasts that it avoids “unfair” exchange rates charged by banks.

Each month, London-based Wise processes more than £8 billion (nearly INR 6,790 crore) worth of international transactions. Over 13 million people and businesses use Wise, which was founded as TransferWise in 2011.

Signing up for a free account takes just a few minutes, and Wise walks you through each step. In addition to registration by entering personal information—your name, date of birth, address and phone number—along with a PAN card and passport or driving license to verify the identity, you can register for an account using your Apple, Facebook or Google account. This login alternative isn’t available with most money transfer services.

Once you’ve registered for an account, Wise might need to verify your identity, typically by uploading a picture of your photo ID and proof of your address. This step usually takes two business days to complete. The need to verify your identity depends on where you’re sending money from and how much money you’re sending; Wise doesn’t verify your identity documents until you initiate your first transfer.

Debit Card

Wise debit card and account details features are not available for Indian users..

Multi-Currency Account

This free account lets you send money in a number of currencies.

Large Transfers

Wise charges lower fees if you send large sums of money.

Wise Assets

The feature is not available for Indian users.

Transfer fees depend on the amount being sent, the type of currency the recipient will get and the payment method. The minimum amount that can be sent in INR to other currencies is INR 5,000.

Wise’s fee is a percentage of the amount being sent.

To calculate the cost of exchanging money from one currency to another, Wise relies on what’s known as the mid-market exchange rate, also called the “real” exchange rate.

When banks buy currencies, they might pay a so-called “buy rate.” And when they sell currencies, they might pay a so-called “sell rate.” The mid-market rate splits the difference between the buy and sell rates. Bottom line: The buy and sell rates include a markup, which eats up more of a sender and recipient’s money than the mid-market rate does.

If you’re sending money in the same currency from one Wise account to another, there is no fee to convert the amount, but Wise charges a nominal fee to complete the transfer. Otherwise, there’s a conversion fee.

Wise lists more than 150 countries where you can send money from India via bank transfer. You cannot send money to someone in India if the recipient is also in the same nation.

It takes anywhere from a few seconds to five business days to receive money through a Wise transfer, depending on the currency being sent. The company says half of its transfers arrive within 24 hours.

Navigation of the Wise website and app is user-friendly, with no glitches during our test of the platform. However, because of the number of countries and currencies available, it can feel a little overwhelming to keep track of the basics (such as fees and exchange rates) for each type of transaction.

To use the free Wise app for an iPhone or iPad, your device must be equipped with iOS 14.0 or later. It is available in 15 languages. The free Wise app also is available for Android devices; the Google Play page for the app doesn’t list specifications for running the app or the number of languages that the app supports.

Wise uses HTTPS encryption and a two-step login process to protect data. The company says it will never “misuse” or sell customer data. However, the App Store page for the app indicates some types of data may be collected and linked to your identity, such as contact information, financial information and search history.

Two tests of Wise’s customer support were disappointing.

When browsing the Wise website, a phone number for customer support was nowhere to be found. Chat and call features are not available for users in India. Even if information on its help center doesn’t resolve your issue, this leaves with contacting via email as the only customer care option.

What if you need an urgent answer to a question but customer support isn’t available?

By the way, Wise prides itself on not using automated systems to answer customer service calls. Its agents do business in a total of 14 languages.

Here’s how Wise stacks up against three of its competitors.

Wise vs. OFX

OFX and Wise enable someone to send money to people in more than 175 countries via bank transfer only. Both charge transfer fees.

Wise vs. Remitly

Remitly allows delivery of cash to a home or business, while Wise does not.

It’s also worth noting that Wise is up front about not being the cheapest option for money transfers. So if cost is an issue, Remitly might be a better choice.

You can send money from India. to another country via bank transfer only.

First, you must sign into your Wise account, choose the amount you want to send, enter the recipient’s banking information and pay from your bank account.

A minimum balance Wise allows Indian users is INR 500 to other currencies.

Wise is a publicly held company whose stock is owned by shareholders. The company’s stock began trading on the London Stock Exchange in July 2021.

Sign up for free and be the first to get notified about new posts.